Ct Estate Tax Exemption 2025

BlogCt Estate Tax Exemption 2025. Federal estate and gift tax exemption: The internal revenue service has published the 2025 estate and gift exemption amounts.

This number doubles for a married estate in order. The principal residence exemption, which allows owners.

The federal government imposes a flat 40% tax on gifts to other individuals, with certain exceptions:

Ct Estate Tax Exemption 2025 2025 PELAJARAN, Residential property owners that are affected by the underused housing tax (uht) have until april 30, 2025, to file their returns and pay the tax for the 2025 calendar year. The internal revenue service has published the 2025 estate and gift exemption amounts.

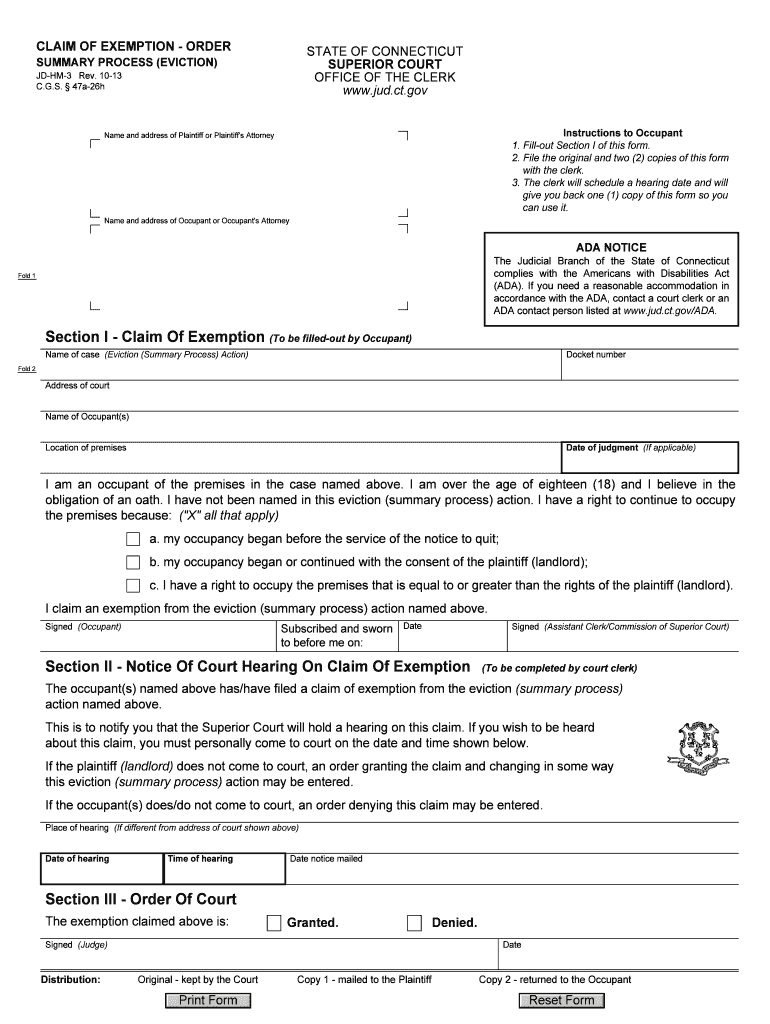

Ct Exemption Summary 20132024 Form Fill Out and Sign Printable PDF, The federal estate tax exemption for 2025 is once again getting a sizable boost to $13.61 million up from $12.92 million in 2025. Federal exemption for deaths on or after january 1, 2025.

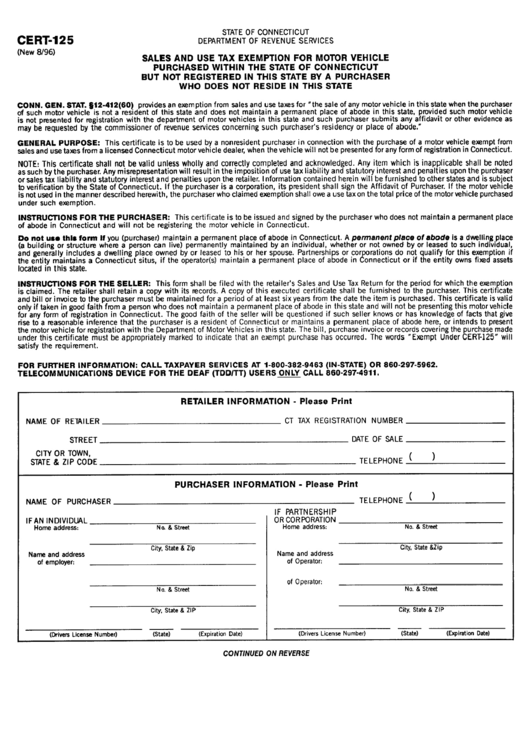

Ct exemption and modification claim form 2010 Fill out & sign online, Federal estate and gift tax exemption: Form ct‐1041es can be filed and paid electronically.

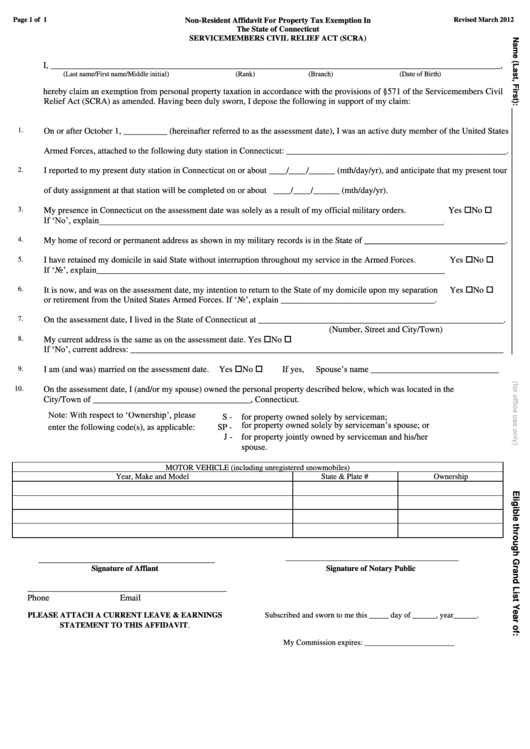

NonResident Affidavit For Property Tax Exemption Form The State Of, As of 2025, the connecticut estate tax exemption will match the federal exemption of $13.61 million. There is also a yearly exemption of $18,000 per person per year.

FREE 10+ Sample Tax Exemption Forms in PDF, The federal government imposes a flat 40% tax on gifts to other individuals, with certain exceptions: The new amounts are as follows:

California ag tax exemption form Fill out & sign online DocHub, Equal to the federal exclusion. Beginning in 2019, the cap on the connecticut state estate and.

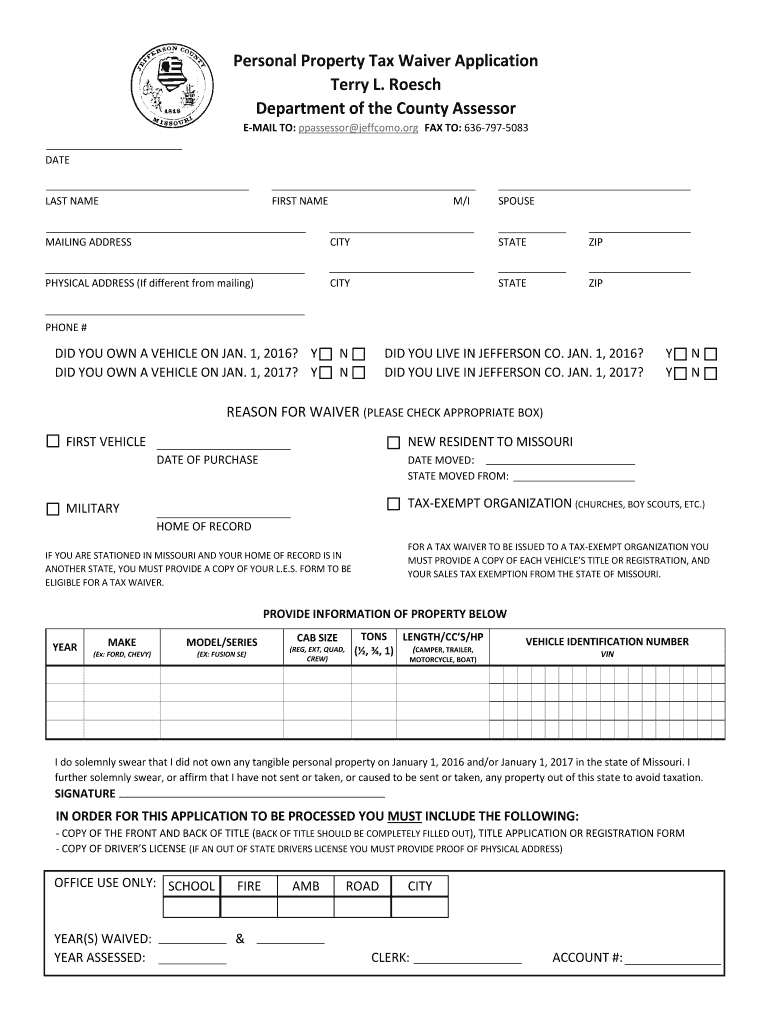

Jefferson county mo personal property tax Fill out & sign online DocHub, The unified exclusion amount is $13,610,000 and the annual gift exemption amount is. (2) certain gifts related to a person’s health care.

Estate and Inheritance Taxes Urban Institute, Karpe, estate planning attorney the federal estate tax can significantly erode your legacy because it. 01/24) payment coupon for trusts and estates.

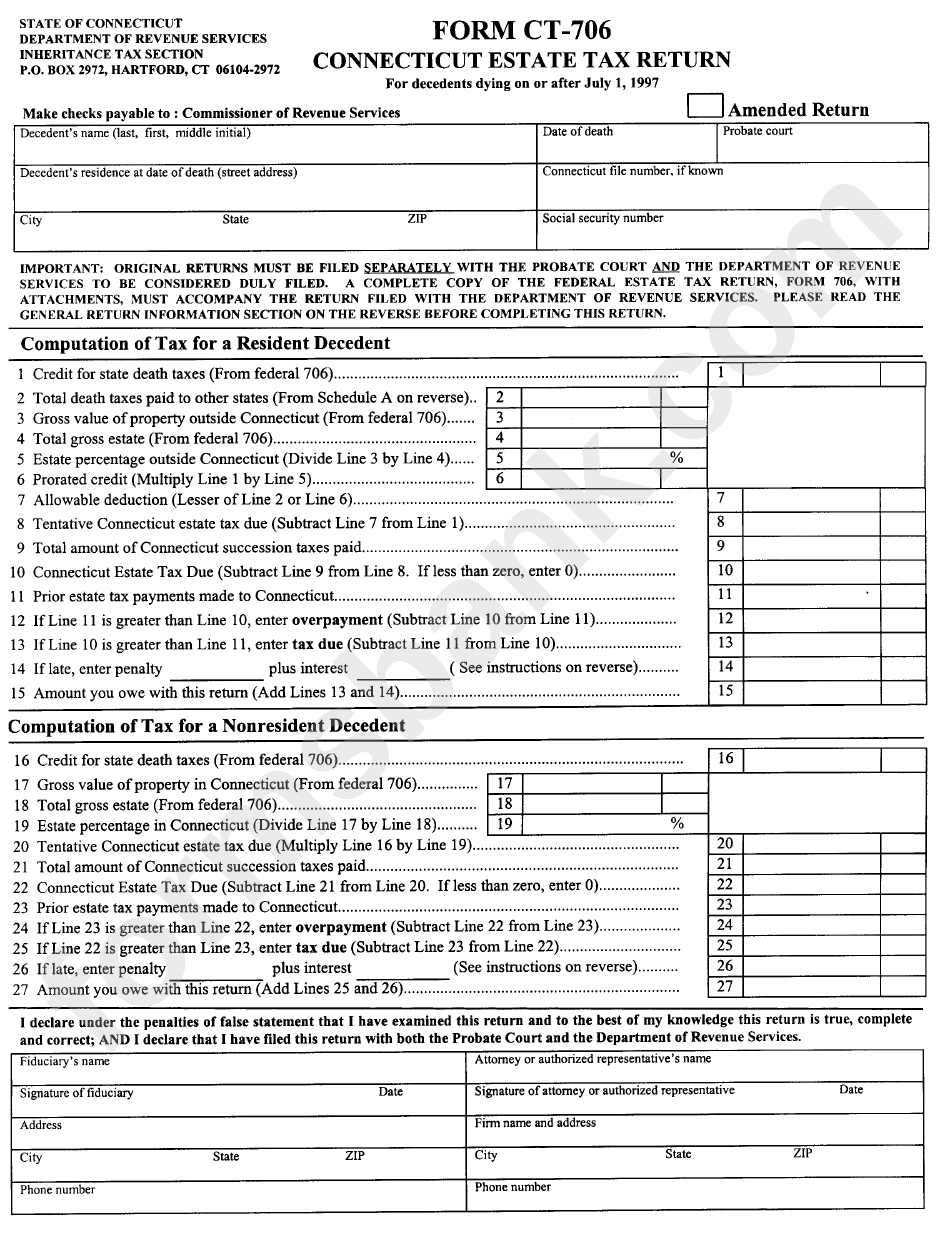

Fillable Form Ct706 Connecticut Estate Tax Return printable pdf download, As of 2025, if your. Equal to the federal exemption amount in 2025 and beyond.

Certificate of TAX Exemption PAFPI, The federal government imposes a flat 40% tax on gifts to other individuals, with certain exceptions: The federal estate and gift tax.

The connecticut tax is different from the federal estate tax, which also has an exemption of $13.61 million (for deaths in 2025).